The Quiet AI Revolution in Mining: Massive Savings and Next-Gen Innovations

According to McKinsey, the potential savings from AI adoption in copper, iron ore, natural gas, coal, and crude oil production could reach a staggering 290 to 390 billion dollars annually by 2035. This prediction underlines the revolutionary potential of AI by revealing not just gradual enhancements but a radical change in the way mining activities will be carried out.

What is even more interesting is that generative AI stands out as a catalyst for unlocking untapped value from existing AI and analytics resources. Interestingly, according to McKinsey, the energy and materials sectors are in a prime position to reap the rewards of these advancements. However, before diving into concrete solutions, let’s briefly explore the current metal companies’ landscape first.

Metals Trading in the Age of Complexity

The complex dynamics of commodities markets, especially in the metals industry, are significant barriers for efficiency of trading processes. Structural shifts driven by the energy transition and decarbonization efforts are reshaping market volatility, leading to supply imbalances and uncertainties. Political factors, supply chain disruptions, and regulatory changes further intensify market complexity, making risk management a critical element for business success. If this topic with a future outlook is interesting to you, read this article by McKinsey.

In this complex landscape, global operations add another layer of challenge for metal companies. Operating across multiple regional trading hubs with diverse systems presents hurdles in managing data and obtaining a consolidated view of risk, especially considering variations in regional time zones. Effective data architecture and integration are essential for mitigating risks in global operations and enabling informed decision-making across all regions.

Moreover, the nature of contracts in commodity trading introduces additional complexities. According to risk.net, metal companies often hedge market risk using physical paper contracts executed on commodity exchanges or over-the-counter markets. Standardizing these contracts presents challenges, as does the reliance on legacy risk management processes that may lack the agility to keep pace with industry advancements. If you’re curious to read more on commodity markets evolution, challenges and policies, we recommend taking a look at this resource.

To navigate these challenges effectively, metal companies must embrace technological innovation and modernize their risk management practices. By leveraging advanced technology, companies can enhance their risk management capabilities and adapt to the dynamic landscape of commodity markets.

All in all, the complexity of commodity markets, especially in the metals sector, requires a holistic approach to risk management. And addressing these challenges requires a deep understanding of market dynamics, the integration of advanced technology, and robust risk management practices. Only by embracing innovation and navigating complexities effectively can metal companies thrive in an increasingly competitive and dynamic market environment.

Without further ado, let’s dive into practicalities of how AI can help, and some already ongoing, interesting projects worldwide.

From Forecasting to Transparency: AI's Role in Reshaping Metal Markets

The mining and metals sector is embracing technological innovation, including AI, to enhance productivity growth, energy efficiency, and operational effectiveness. This shift is reflected in the adoption of AI-powered solutions in commodity trading, where advanced analytics and predictive modeling are driving informed decision-making and risk management strategies.

The US Department of Defense, or to be more specific, the Pentagon, is leading an initiative to utilize AI in estimating prices and predicting supplies of critical minerals such as nickel and cobalt. By leveraging AI capabilities, they aim to enhance market transparency and forecast accuracy, addressing the challenges caused by volatile market conditions.

Meanwhile, researchers at the National University of Singapore have made significant strides in AI-driven base metal price forecasting. Their AI model, which utilizes large-scale alternate data sources including market data, macroeconomic data, and social media information, has outperformed traditional linear models in accuracy for out-of-sample forecasts. This development offers valuable insights for commodity traders and financial institutions seeking to navigate the complexities of metal commodity trading.

The Financial Times has also weighed in on the potential of AI in revolutionizing metals pricing. By analyzing supply and demand dynamics for critical minerals like nickel and lithium, AI can enhance price discovery and predict supply-demand trends. The US government is considering leveraging AI to improve market transparency and forecast accuracy, underscoring the growing recognition of AI’s role in reshaping the metals commodity trading landscape.

Looking for insights on commodity prices in 2024 and beyond? Check out How to Fetch Commodity Prices in 2024 for a glimpse into the future of price fetching.

Streamlining Metal Trading: How Zeta's Cognitive AI Copilot is Changing the Game

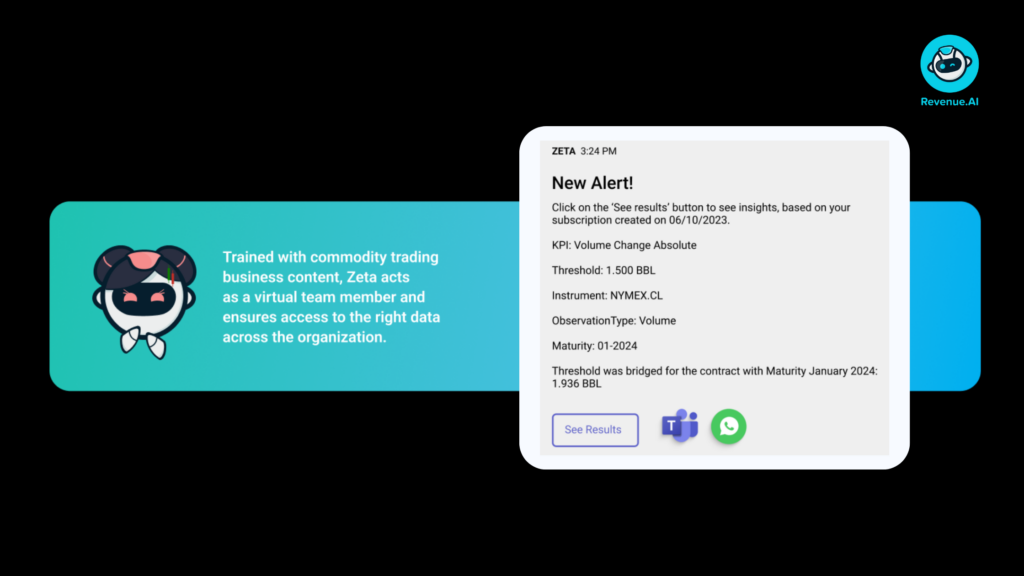

AI Copilot tools like Zeta are revolutionizing commodity trading, particularly in the domain of copper, gold, silver, platinum, and palladium trading. These AI-powered tools offer a variety of benefits, ranging from real-time data visibility to automated insights, aimed at streamlining operations and enhancing efficiency across various metal markets.

Zeta, for instance, stands out for its ability to handle data at superior speed compared to traditional methods, enabling traders to make informed decisions promptly across a diverse range of metals. By automating processes such as price quality checks and reconciliation, Zeta not only saves time but also ensures accuracy, mitigating the risk of errors in trading precious metals like gold and silver. Learn more about Zeta, here.

One of the key advantages of AI Copilot tools like Zeta is their capacity to provide real-time alerts and communication, keeping traders aware of market developments and potential opportunities in metals such as platinum and palladium. This feature empowers traders to react swiftly to changing market conditions, maximizing profit potential and minimizing risks across various metal markets.

Moreover, Zeta’s integration of clean price data ensures reliability and consistency across all metals, increasing traders’ confidence in their decision-making process.

In addition to real-time data access and automated insights, Zeta offers a suite of features designed to enhance operational efficiency across diverse metal markets. From automatic data processing to on-the-go reporting capabilities across all metals, Zeta equips traders with the tools they need to navigate the complexities of commodity trading with precision and confidence.

By leveraging AI Copilot technology across all metals, traders can gain a competitive edge in the market, leveraging real-time data and insights to make strategic decisions that drive success across a wide spectrum of metal markets. Learn about specifics here.

As the commodity trading landscape continues to evolve across various metal markets, AI Copilot tools are for sure to play a pivotal role in shaping the future of the industry.

Want to learn more about AI copilots in various industries? Explore articles like AI Copilots in the Coffee Industry to see how AI is revolutionizing trading beyond metals.

Charting New Horizons: The Future of Metals Trading with AI

The integration of AI in metals commodity trading has far-reaching implications for market participants, and according to White & Case, technology is the hottest commodity in the mining and metals sector. By offering advanced analytical insights and predictive modeling capabilities, AI enables informed decision-making and risk management strategies. Furthermore, AI-driven solutions have the potential to enhance market efficiency and transparency, thereby fostering greater trust and reliability in the commodities market.

Looking ahead, the future of AI in the commodities sector is promising. Further advancements in predictive analytics, expanded use cases across the value chain, and regulatory considerations are expected to drive continued adoption of AI technologies. As market participants continue to harness the power of AI, the metals commodity trading landscape will assuredly witness continued innovation and transformation.

Stay Ahead of the Curve: Embrace AI for Smarter Metals Trading

To summarize, the integration of artificial intelligence is revolutionizing metals commodity trading, offering advanced tools for price data gathering and analysis, risk management, and decision-making processes. Recent developments highlight the growing significance of AI in addressing the challenges posed by volatile market conditions and supply chain complexities. As AI technologies continue to evolve, the future of metals sector and commodity trading promises greater efficiency, transparency, and innovation.

Our recommendation is to embrace the power of artificial intelligence and stay ahead of the curve in this dynamic industry. Whether you’re a seasoned trader or a newcomer to the field, now is the time to explore AI-driven tools and strategies that can enhance your decision-making, streamline operations, and maximize profitability.

You can even take the next step towards success by integrating AI Copilot tools like Zeta into your trading toolkit. With real-time data visibility, automated insights, and operational efficiency across all metals trading, Copilot tools can empower you to navigate the complexities of commodity trading with precision and confidence.

Start your journey towards smarter, more profitable trading from today.