The Power Players: Dissecting the Role of the Middle Office in Today's Global Commodity Markets

In the continuing growth of global commodity markets, the middle office function is the hidden champion, making sure transactions are booked and valued correctly and ensuring accurate reporting of PnL and exposures.

As we zoom into the complexities of this ever-changing market, it’s interesting to note some alarming facts that shed light on the range of responsibilities and challenges that middle office professionals face:

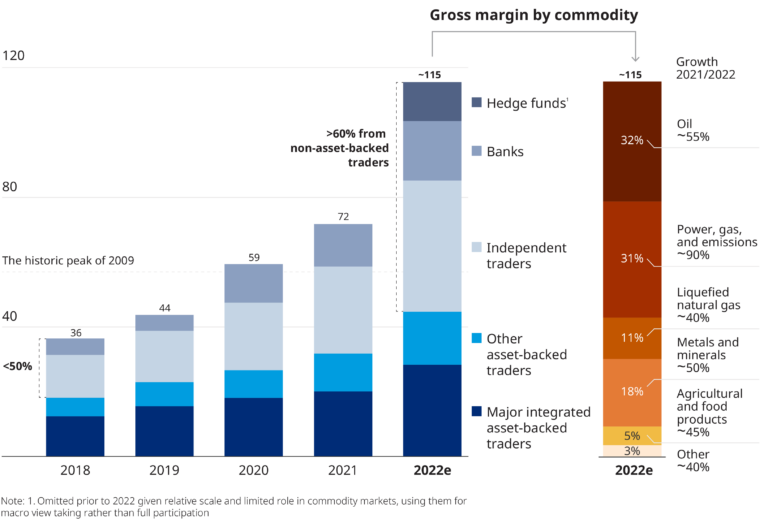

Commodity Trading Gross Margin Growth

The commodities trading sector had explosive growth in 2022, breaking through to record highs with a gross margin of over $100 billion. This growth was fueled by the extreme volatility of the commodities markets, especially as a result of changes in global supply chains brought on by the conflict between Russia and Ukraine. Take a look at the image below for more insights.

Major market variables, such as high levels of uncertainty, fluctuations in trade flows, rising demand, and higher cash requirements, gave traders the chance to profit from shifts in the market. Additionally, the year saw unheard-of levels of volatility, especially in the energy markets, which gave traders plenty of chances to benefit from changes in prices. Go here to learn more about the topic at hand.

This enormous number highlights the critical function that the middle office performs in overseeing the complex network of transactions and investments.

Commodity Market Growth

The global market for commodity trading services, estimated by EIN Presswire to be worth USD 4.10 billion in 2023, is expected to increase at a compound annual growth rate (CAGR) of 8.74% from 2024 to 2030 to reach USD 7.37 billion. Consequently, this highlights the necessity of cutting-edge middle office solutions to manage the spike in trade activity. This expansion presents opportunities as well as challenges, requiring a technological leap to keep up with the changing dynamics of the business.

Costs of Manual Processes

From our experience with clients, relying predominantly on manual processes in middle office operations incurs an average of 40% higher operational costs compared to those utilizing advanced automation.

The financial impact of outdated processes is a compelling argument for the adoption of cutting-edge solutions that streamline operations and reduce costs. If this is an interesting topic, we recommend that you check out this article, and learn more.

Middle Office Challenges & The Opportunity for Automation

Real-time visibility into trade positions and risk exposure is now more critical than ever. The inability to promptly assess positions and exposure can lead to suboptimal decision-making and missed opportunities. Furthermore, the middle office’s significant data flow necessitates the use of reliable technology to handle the complexities of trade administration.

Delays in middle office risk exposure evaluations, which could result in financial losses, are another noteworthy concern. Not only is real-time visibility into trade positions convenient, but it’s also essential for reducing risks and arriving at wise trading decisions.

The adoption of technology is still another unanswered matter. Some commodities trading companies still rely on manual processes and outdated systems in their middle office, which makes it difficult for them to adjust to changing market conditions despite the quick advancement of technology. This emphasizes how modernization and automation must become the new framework to maintain competitiveness in the quickly changing commodity markets.

In the middle office, there is a great chance for automation and modernization despite these obstacles. Automation may prevent complications linked to human errors with immediate effects such as optimized operations, decreased expenses, boosted productivity, and real-time data visibility. Zeta Copilot stands out as a top option, providing an extensive toolkit to transform middle-office functions.

Zeta Copilot: Bringing Automated Price Checks, Integrated Data Handling, and AI-Enhanced Efficiency

Zeta, the AI Commodity Trading Copilot, provides an innovative approach for boosting productivity, dependability, and well-informed decision-making.

- automate and streamline processes in commodity trading

- provide real-time data visibility

- enhance efficiency

- support risk mitigation

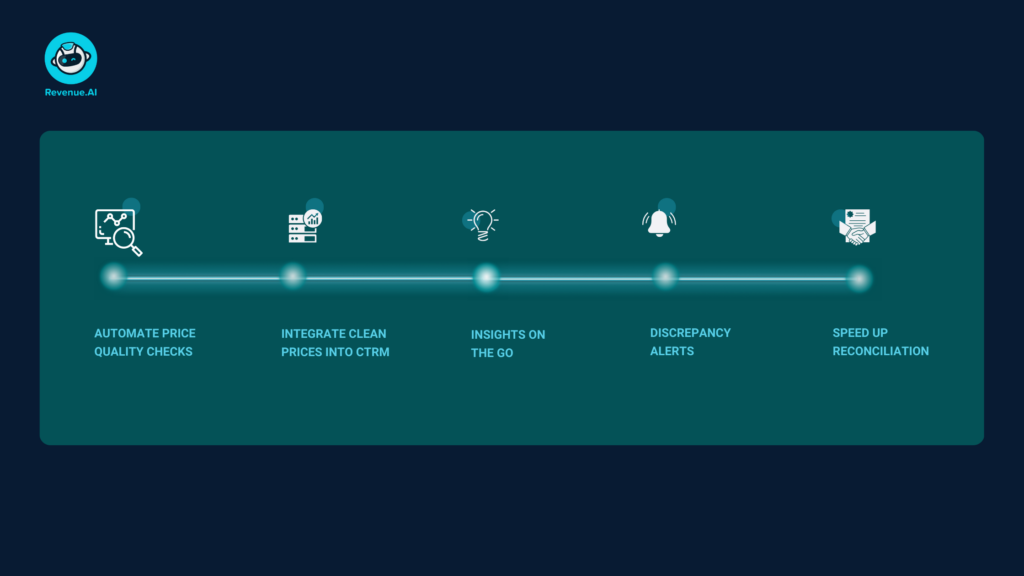

Zeta Copilot is designed to automate price quality checks, integrate clean prices into E/CTRM systems, and accelerate the reconciliation process between the middle office and traders.

What sets Zeta apart is its ability to keep users informed in real-time through their preferred messenger platform, providing alerts on P&L discrepancies, contracts, physical trades, and delivery schedule warnings and notifications in a user-friendly chat layout.

The key elements of Zeta’s impact on improving middle office dynamics are outlined below:

- Middle Office Flow Management: Zeta is designed to increase the workflow efficiency of the middle office. By optimizing and simplifying operations, and removing manual work, Zeta contributes to a more agile and responsive middle office.

- Independent Price Verification/Validation: Manual validation of trade data against market information is risky and prone to an increased number of errors that can impact decisions later on. As Zeta Copilot automates price quality checks, it ensures accuracy and reliability in the price verification process, reducing the chance for any errors to slip in.

- Cognitive Insights: Cognitive insights are essential in the age of data-driven decision-making. When connected to our pricing platform, APIs or a variety of data sources, Zeta uses the available data, machine learning and advanced analytics to deliver actionable insights for informed decision-making. As Zeta uses Natural Language Processing, the insights are delivered in a chat interface, via your favorite messenger, in a way anyone can understand them and gain a 360 view of the commodity markets.

In summary, by adopting the Zeta Copilot, middle office can enjoy multiple benefits, such as:

- Streamlined Operations: Zeta’s automation capabilities contribute to a more efficient and streamlined middle office workflow.

- Reduced Costs: By automating processes and minimizing manual intervention, Zeta helps to reduce operational costs.

- Increased Efficiency: The real-time visibility and automation provided by Zeta enhance overall efficiency in trade management and related activities.

- Real-time Data Visibility: Zeta ensures that users have access to real-time data, enabling quick and informed decision-making.

Modernizing Middle Office: Zeta Copilot's Role in Shaping Future Commodity Markets

In conclusion, due to the increase in international trade volume and the expanding market for commodities, manual processes are not a solution anymore from a productivity and cost perspective.

Both in terms of financial effect and operational efficiency, manual operations are expensive. It becomes clear that automation is crucial in the middle office when dealing with issues like delayed risk exposure assessments, real-time visibility, and technology adoption.

Zeta Copilot is a game-changer since it provides an extensive toolkit with the goal of transforming middle-office processes. It is positioned as a disruptive solution due to its capacity to automate pricing quality checks, optimize processes, and offer real-time information. Zeta Copilot simplifies manual operations by offering capabilities like master data management, independent pricing verification, and cognitive insights.

Adopting Zeta Copilot has tangible advantages, such as more efficient operations, lower expenses, and critical real-time data visibility.

Curious how you can implement this in your company? Learn more via a personalized 1:1 session.