Before we jump right into ideas for managing price volatility and seizing arbitrage opportunities with AI, we have to reflect a bit.

So, regardless of how well they work, traditional commodities trading tactics can be both time- and labor-intensive. The labor-intensive monitoring of news and events, the analysis of massive amounts of historical and real-time data, the identification of price discrepancies across trades, and the need to execute trades quickly to take advantage of fleeting opportunities are just a few of the difficulties faced when employing conventional commodity trading strategies.

The decision-making process for traders is further complicated by the growing complexity of handling data and analytics in commodities trading due to the rapid growth and availability of new data sources.

Additionally, the transition towards renewable energy and its impact on commodity markets introduce unique opportunities and challenges that require adaptation. These difficulties highlight the need for a more automated and efficient method of gathering commodities insights.

AI-driven solutions provide a more automated and modern approach to commodities trading in response to these issues. AI systems can automatically detect pricing discrepancies across exchanges, assist in quickly executing trades based on predefined criteria, monitor news and events in real-time, analyze historical and real-time data to identify patterns and trends, and more by utilizing sophisticated algorithms and machine learning techniques.

Furthermore, by automating data gathering, cleansing, and analysis, AI technologies simplify data manipulation and free up traders to concentrate on making strategic decisions rather than handling data processing responsibilities. In general, artificial intelligence (AI) solutions provide a more effective, precise, and automated method of decision-making and execution in today’s dynamic market environment, hence mitigating the difficulties encountered by conventional commodities trading tactics. We talked about this topic in depth, so if you are eager to learn more about it, proceed to the article here.

Let’s dive into practical examples and show you exactly how this is possible.

Managing Price Volatility with Zeta

Commodity traders employ a range of tactics, such as demand management, supplier strategies, and financial hedging, to control price volatility. However, in addition to it, effective commodity price volatility management also requires the implementation of suitable sustainability practices, a strong control environment, and sophisticated trading and reporting systems.

Although commodity traders have historically relied on these tactics, the landscape is rapidly evolving. Therefore, it is essential to integrate cutting-edge technology like artificial intelligence (AI) combined with a proper data strategy to be able to ensure continued commodity trading success.

Zeta is at the center of this change, through its market data capabilities and applicable insights to improve the efficiency of all commodity trading practices. Zeta is an AI-driven Commodity Trading Intelligence Copilot developed by Revenue.AI.

If this is your first time on our blog, visit this page to learn more about its capabilities. However, in a nutshell, powered by large language models (LLMs), Zeta sifts through extensive datasets, providing context-aware assistance and replacing manual work by automating time-intensive tasks.

When it comes to controlling price volatility, Zeta is leveraging state-of-the-art AI algorithms and up-to-the-minute market data, to empower traders to make informed decisions. By streamlining data retrieval and providing on-the-go access to reports, market trends, and risk factors, Zeta enables traders to effectively mitigate the impact of external market price fluctuations. This helps traders efficiently reduce the influence of external market price swings by staying informed and enabling them to act before unexpected fluctuations hurt their performance.

According to Delloite, companies should leverage a mix of new pricing and supply management strategies that go beyond traditional methods to lessen the effects of such volatility. Read the full article here, if you are interested.

Additionally, Zeta’s platform integration makes supplier strategy easier by providing analytics and supply chain visibility. Zeta helps traders optimize their sourcing strategy, whether through long-term supply contracts or spot buying, lowering dependency on specific resources and boosting supply chain resilience by keeping an eye on supplier performance and market trends. Learn more about how Zeta can enhance your supply chain visibility and performance by reading this article.

Zeta’s capabilities provide valuable insights into demand patterns, facilitating effective demand management and optimization. By leveraging these insights, Zeta enables traders to minimize supply chain disruptions through optimized inventory management and reduced dependency on volatile commodities. Through real-time insight-driven adjustments to manufacturing and supply chain activities, Zeta empowers proactive responses to fluctuating demand, ensuring smoother operations.

Moreover, traders can see their overall risk exposure across a range of commodities thanks to Zeta’s integrated commodity risk management features. Zeta helps traders use proactive risk mitigation techniques, ensuring resilience against unpredictable commodity prices, through close monitoring of instantly available market data.

All in all, Zeta gives traders the ability to confidently and resiliently negotiate the intricacies of commodities markets by leveraging the power of AI-driven insights.

Spotting Arbitrage Opportunities with Zeta

Because of the urgency with which one must detect market inefficiencies, identifying arbitrage possibilities can be difficult. To find these chances, traders employ a variety of instruments and techniques, including technical analysis, automated trading algorithms, and real-time data feeds.

However, the technological arms race and transaction costs add complexity and risk to arbitrage opportunities. Timing is also crucial, as price discrepancies in the market do not last long. Read another useful article by Deloitte covering this topic here.

Apart from handling the difficulties associated with controlling price fluctuations, Zeta is also essential for spotting and seizing arbitrage possibilities in commodities trading. Zeta uses advanced artificial intelligence algorithms and real-time market data to simultaneously scan different markets and identify pricing disparities and inefficiencies.

To tackle this challenge, Zeta finds arbitrage opportunities when commodities are priced differently in multiple marketplaces by examining pricing data from exchanges, locations, and time zones. These pricing variances might be the result of several things, including inefficiencies in the market, variations in regulations, transportation costs, and supply and demand.

Once arbitrage opportunities are identified, Zeta provides actionable insights to traders, enabling them to execute arbitrage trades effectively. Whether it’s exploiting price differentials between futures contracts and spot markets or taking advantage of geographical arbitrage opportunities, Zeta offers real-time recommendations to maximize profitability. By leveraging its advanced analytics, Zeta empowers traders to capitalize on price differentials across markets, enhancing profitability and performance in commodity arbitrage strategies.

Before we wrap it up, another important topic should be addressed. Besides catching valuable trade and arbitrage opportunities, traders need to continuously reassess and adapt their pricing objectives to new market realities, ensuring that pricing strategies are aligned with the broader business direction.

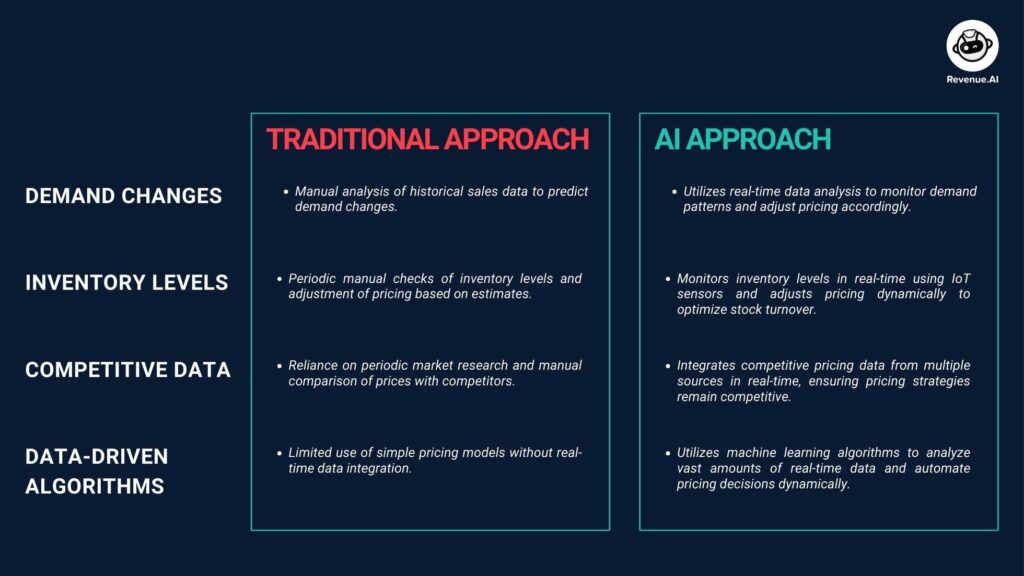

Dynamic price optimization is one of the strategies that can help commodity traders make informed decisions on pricing based on real-time pricing and demand trends. Dynamic pricing strategy automates price adjustments based on data-driven algorithms fueled by factors such as demand changes, inventory, and competitive data.

To be successful, dynamic pricing needs to combine the age-old wisdom of the trader with machine learning. Overall, dynamic pricing can help traders increase sales, meet sales targets, and avoid the accumulation of deadstock, thereby freeing up choked cash for the trader. However, dynamic pricing is both an art and science, and a test-and-learn approach is crucial to getting it right. Learn more about dynamic pricing here.

The Commodity Trading Revolution

In conclusion, commodity trade strategies have evolved in response to labor-intensive procedures, complicated data, and the shift to renewable energy sources. Zeta and other AI-driven technologies have changed the game by automating decision-making and reducing risks.

Zeta not only gives traders more power by supporting the decision-making for managing price volatility and identifying arbitrage possibilities, but it also paves the way for a time in the future when AI will further transform commodities trading.

We may anticipate even more advanced AI-powered solutions that enable traders to seize fresh opportunities and experience long-term development in the dynamic world of commodities trading as the technology continues to advance.