Information-Driven Organization – Or Is It?

Today’s businesses that do not nurture the environment where key information is available and promptly communicated at a short notice risk ending up behind the curve. Take the case of the recent Archegos collapse and its ripple effect on some of the largest banks around the world. Goldman Sachs, due in part to their information agility, managed to come out almost unscathed, Morgan Stanley suffered some losses but managed to relatively quickly hedge their exposure, whereas Credit Suisse, the Swiss banking giant, has borne the full brunt of the meltdown with their former risk manager Lara Warner indicating she was not even aware of some key insurance contracts expiring on the eve of the collapse (source – Reuters article). Total damage is approx. $4.7B for not having the critical information at hand and, thus, doing nothing.

And while this case has garnered a lot of attention as of late, primarily due to its outsized losses, most businesses chronically suffer from key information deprivation in their daily activities.

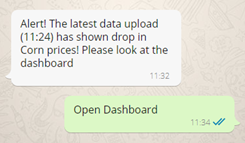

Whether it is a price of corn collected by a field analyst but not updated in the central repository quickly enough nor distributed to traders, or a product promotion based on a rule of thumb rather than data, businesses these days are forced to capture, process, and ensure quick access to information.

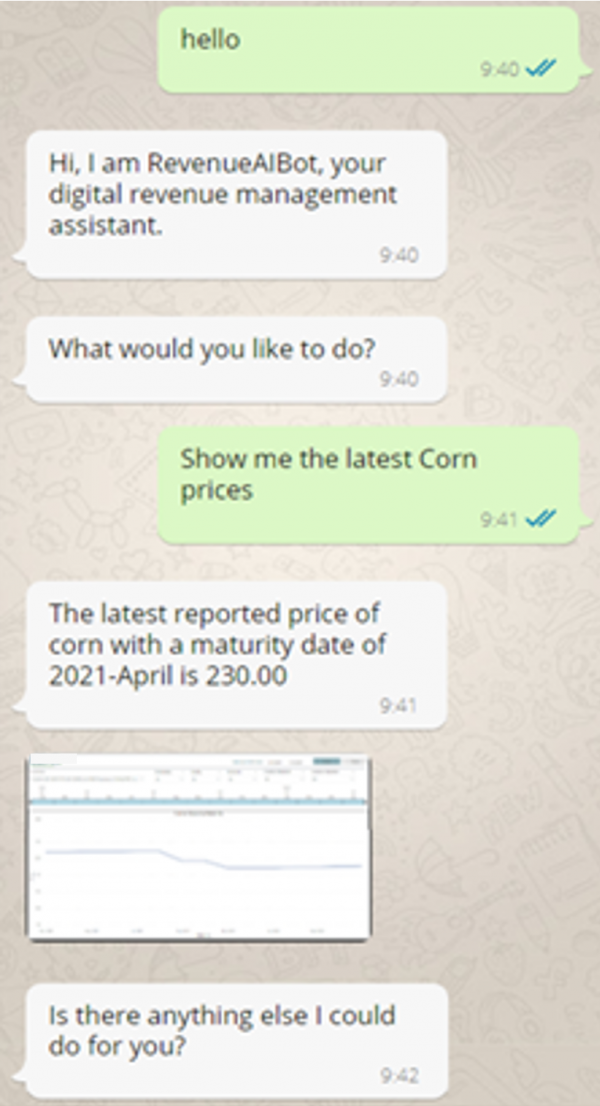

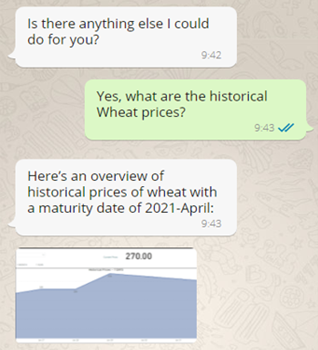

This is where virtual assistants (chatbots) come into play. Why bother trying to find this report or go to that dashboard when all you need to do is ask. How many times did you need just one number but had to execute and eyeball the full report? And how often you wished you had the ability to quickly update the report with key information you just discovered?

Quantitatively speaking, going via the report route + further drilldowns to retrieve needed information takes anywhere from 1 to 10 minutes depending on the performance of the report. Juxtapose this with approximately 5 seconds required to type a quick question and get an exact answer. A medium size company roughly has 45K requests for specific information daily, being a very conservative estimate. We look at savings from 690 to 6900 hours (45K to 450K minutes divided by 60 and subtracting the 5 seconds per request using the intelligent assistant) depending on how long it takes to run a report. Taking the fastest report route, 690 hours saved daily translates into 27.6K USD assuming a $40/hour average employee rate.

And what if we throw emails and other processes into the picture when 1min per key information request becomes hours and in some cases days.

Fetching Prices in the 21st Century

In the trading world, analysts and traders face some challenges on reaching out the information, like the need for exporting the fetch prices, instantly sharing insights discovered with the team, getting alerted about the target prices, and doing all of these with single clicks via your mobile phone.

What we have seen that traders and analysts in one of the largest commodity trading firms indicated they need to be able to:

- Have some “app” or “assistant” that can gather prices from multiple channels and provide it upon request

- Get alerts of the fluctuating prices to make on-the-spot decisions.

- Broadcast and share their inputs with a group of teammates.

- Input commodity forward prices using a template or a quick survey-like screen, both from the field and at their desks.

- Immediately act on a freshly received Price / information in any system, or just alert someone else and forward the message

- Be reminded of when new price changes inputs are expected.

Having addressed these challenges with the Intelligent Assistant we went back to ask which features you experienced have been the most beneficial in your line of work. Some answers were:

- Getting exact answers to price requests is a great time saver to me.

- Our Power BI suite of reports is reaching the critical mass and we are sometimes getting lost in them. Not having to go via the platform to get what I need and so quickly has proven its worth.

- I liked getting the filtered report to what I originally asked.

- In general, I don’t like getting reminders, but getting it from a robot… I’m ok with it.

- Querying the price from Zema, our price platform, has been a breeze. No need for any logins.

- Working in the field and being able to upload and communicate a price wire using my cell phone eliminates me having to do it in the evening.

What if, instead of logging into a Bloomberg or Reuters Terminal or going to any of the ERP systems like SAP or Oracle or Microsoft based suite, you could just ask a question to your intelligent assistant, then it goes and fetches the answer you are looking for from the relevant source of truth? After closely observing the trading world, Revenue.AI came up with a solution to ease traders’ access to price information, and developed Zeta, first-ever intelligent assistant for commodity traders.

Introducing ZETA - First Ever Intelligent Assistant

The global commodity trading industry is a complex, fast-paced business that requires high levels of information and decision-making to succeed. Business leaders need a solution that can help reduce the complexity of the industry while empowering their growth.

Revenue AI proudly introduces Zeta, an intelligent assistant for the commodity trading industry, helping to reduce complexity and empower growth. She automates decisions and empowers business leaders to focus on strategy with integrated approval cycles and trade automation. She builds a strong connection between business strategy and everyday execution in the field with enhanced Analytics.

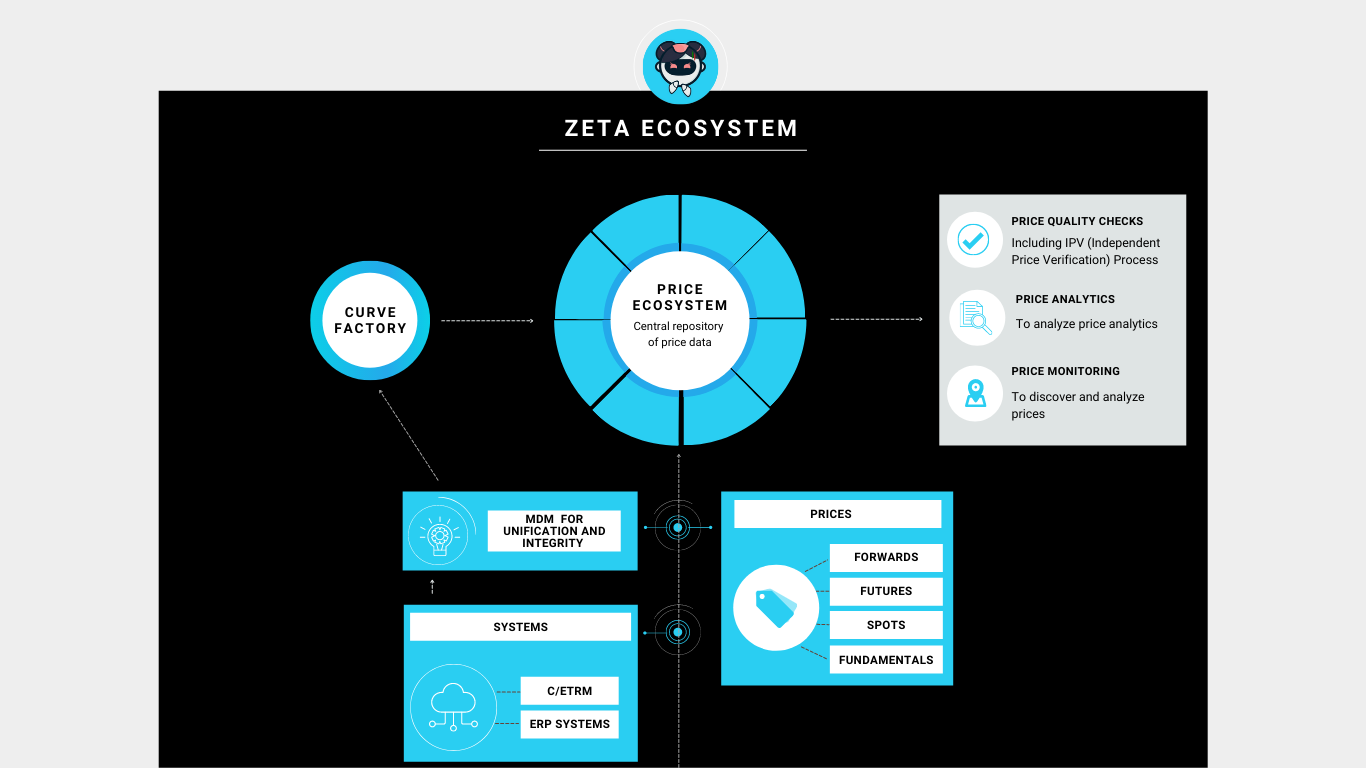

Zeta is a new intelligent assistant that allows commodity traders to automate hundreds of tedious and time-consuming tasks, saving them valuable time and money. Zeta does not merely perform manual functions, but also takes into account the specific nature of trading business and the market you operate in to ensure the best possible results. With her four pillars, Zeta mainly deals with managing prices.

Zeta helps you optimize pricing strategies, monitor competitors’ and your own prices, and easily detect errors in your market data. Her goal is to bring artificial intelligence (AI) to the price optimization process and make it available for everyone at an affordable price. Zeta is using modern neural network technology combined with a unique pricing engine that includes every factor influencing market prices in her algorithms, which allows her to leverage all available data and use it in the most accurate way possible. Thanks to this approach, Zeta can help you optimize your pricing strategy while staying within your budget. Her price monitor feature helps you stay on top of trends in your industry and find out about the latest events.

Using these features, Zeta helps commodity traders make sure that they’re always offering competitive prices and gives them a clear picture of what the rest of the market is up to.

Revenue AI Intelligent Assistant for Trading, in Action

Let us make it simple. You are trading in one of the commodities (Oil / Coal / Wheat / Sugar / Coffee / NatGas) and your team is a group of 3-10 people around the globe.

- Probably you already have a WhatsApp communication channel to distribute prices

- Probably you already have plenty of sources of information like the Bloombergs and the Reuters of this world

- Last but not least, you may have some internal information tidbits stashed somewhere in Excel? Or Dropbox. Or Google Drive

What you can do with Intelligent Assistant is already a lot and with time functionality will increase:

- Ask for any price, no matter where it is

- Ask for any price from any source

- Insert prices for any commodity you are dealing with

- Forward / Distribute it inside your team

- Your assistant will alert you of any changes if you choose to be notified

- Gather all these prices in one place

And this is all done using the application which you most likely have already installed on either your personal or work laptop or a mobile device.

Conclusion

Fancy a business where you instantly receive active recommendations on what to buy and when. Sophisticated algos are at work to ensure your team is equipped to anticipate market changes and to immediately alert you based on the most recent trends. And we haven’t even started talking about automating your trading decisions and subsequent monitoring actions.

This is the vision of Revenue AI’s Intelligent Assistant, Zeta, we are working on today.

To learn more and start your new trading era with Zeta, get your demo today and let us help you get the most out of your commodity trading business.