But what is price elasticity and why it is important?

Elasticity essentially measures the responsiveness of an economic variable when a change occurs in another given variable. Think of it like mixing chemicals in a lab, or if you’re more artistically inclined, like mixing colors. There’s a causal relationship between economic variables, and elasticity seeks to measure the extent one variable is affected by a change in another variable.

So, how many drops of yellow in blue do you need to attain the perfect shade of green?

Elasticity can be broken down into three main types:

- Price elasticity of demand

- Cross-price elasticity of demand

- Income elasticity of demand

In simplistic terms, price elasticity measures how a change in the price of a given product or service will affect the quantity of demand. For example, if the price of a product increases by 10%, it stands to reason that fewer consumers will then purchase this product.

But how many consumers will change their purchasing behavior? This is the question that price elasticity of demand is burning to answer.

What affects price elasticity in the CPG industry?

The consumer-packaged goods industry is reliant on two principal factors: price and speed. CPG products are meant to be sold quickly and at a relatively low cost; they are simple and easy purchases for the consumer to make. When either of these two factors is changed, the demand for the given product will likely be greatly impacted.

In 2022, we are witnessing unprecedented inflation, forcing manufacturers to hike up prices every month in an effort to offset the rising cost of raw materials. But each decision made to raise prices can have damaging consequences. Lowering prices, on the other hand, is an even more complicated process. In some channels, it may even be impossible.

To compare the process to working as a technician in a bomb disposal unit would be accurate. There is no room for mistakes in this job. One wrong move and the bomb detonates – just like with prices. Pinpoint accuracy is required.

But in times of inflation, this accuracy is compromised. It is impossible to determine demand without needing to recalculate price elasticity and its factors with every influx of new data.

Using a linear regression model to estimate the price elasticity of demand, in addition to using statistical modelling to estimate the model, you can calculate both price elasticity and cross-price elasticity by using Python.

But, in a real-world application, you should expect that all prices – yours and those of your competitors – are constantly changing amid thousands of possible scenarios. In light of this fact, both price elasticity & cross price elasticity must be calculated continuously with every new data insight and for each channel.

What stumbling blocks do you encounter when you run price elasticity calculations during a period of strong inflation?

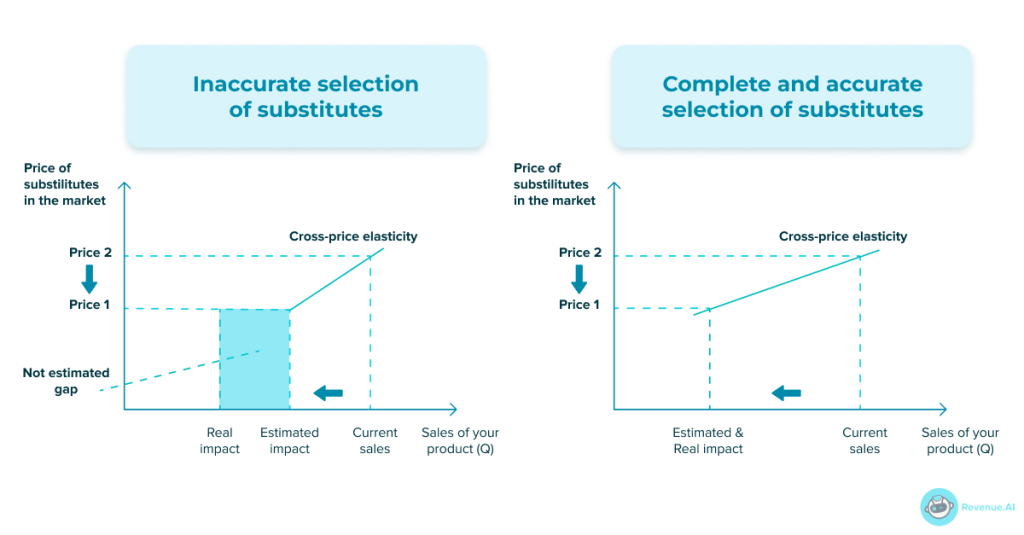

The most critical issue we need to take note of is that the accuracy of cross-price elasticity calculations depends on precisely identifying competitor and substitute products. This is a monumental endeavor.

With massive amounts of big data sets, SKUs, and the wide array of trade channels, identifying competitors and substitutes per channel would be impossible without strong AI support.

Given that demand function depends on price elasticity, cross-price elasticity, macroeconomic factors, and fluctuations in GDP, it would be impossible to predict the impact a change in prices has on demand without a solution that takes all these factors into account.

How to become agile with the help of an AI-driven turn-key RGM platform.

The engine of Revenue.AI’s platform – which is based on a combination of ML- algorithms, NLP and other technologies – provides turn-key solutions for revenue growth management and pricing.

Inside the platform, price elasticity and cross-price elasticity modelling based on an AI-driven identification of competitor and substitute products – all in real-time – lets you secure your margin and make decisions based on the most up-to-date data without spending time on data preparation and unification.

The mass-simulation engine enables you to find the best scenarios, prioritize price changes that lead to an optimal impact and take full advantage of market movements while avoiding potential negative effects on profit.

Check out our Precision Pricing Module – an AI-driven cloud tool that provides you with a complete analysis and includes price elasticity, cross-price elasticity as well as identification of competitor & substitute products.

Additionally, the advanced-technology tool includes product margin maximalization algorithms, intelligent alerts support and smart notifications via the AI-powered virtual assistant robot, RAI.

With this powerful Revenue.AI tool in your arsenal, you can confidently make pricing decisions in an environment characterized by dramatic and continual inflation.

When you’re tasked with predicting market movement in highly volatile situations, would you like to be able to make data-driven decisions? Reach out to our team and plan a demo so we can show you exactly how our virtual assistant can help you navigate these challenging times.