Exploring Organizational Efficiency

Organizational efficiency is just one of those topics that will always be relevant and worth talking about. We keep inventing ways of doing or achieving more with less time, resources, etc. Now, imagine if you didn’t need to do some things at all. How amazing would it be if someone or something could simply do it for you?

Today, we’ll dive into how Revenue.AI helps increase operational efficiency in commodity trading. In such volatile markets, where P&L can fluctuate rapidly, having the right information at the right time is especially crucial. Especially since, as neatly explained by McKinsey, from a commodity trader’s perspective, profitability is determined by a combination of price levels and price volatility. Additionally, markets have experienced historic spikes caused by COVID-19, severe weather, geopolitical events, and macroeconomic uncertainty. Feel free to read on, here.

So, with all the constant changes and the need to adapt, why not use the most out of technology for insights on reacting to all these changes quickly? Now more than ever, there is no time to wait for someone to do something manually.

We certainly do believe that the future is intelligent, which we announced already on our new platform launch in March. In case you missed it, feel free to watch it on demand here. Without further ado, we’ll dive into details of how to increase operational efficiency in the commodity trading industry.

Middle Office Operational Efficiency with RAI

Let’s focus on Middle Office first. To be able to make informed decisions, you’d need to identify and resolve any discrepancies or inconsistencies in the data first. However, data reconciliation is a time-consuming process, especially when done manually. It takes a lot of time to compare and verify data from multiple sources to ensure that it is accurate, consistent, and complete. You also probably need to switch from Excel and other platforms until you complete it, which is tiring enough.

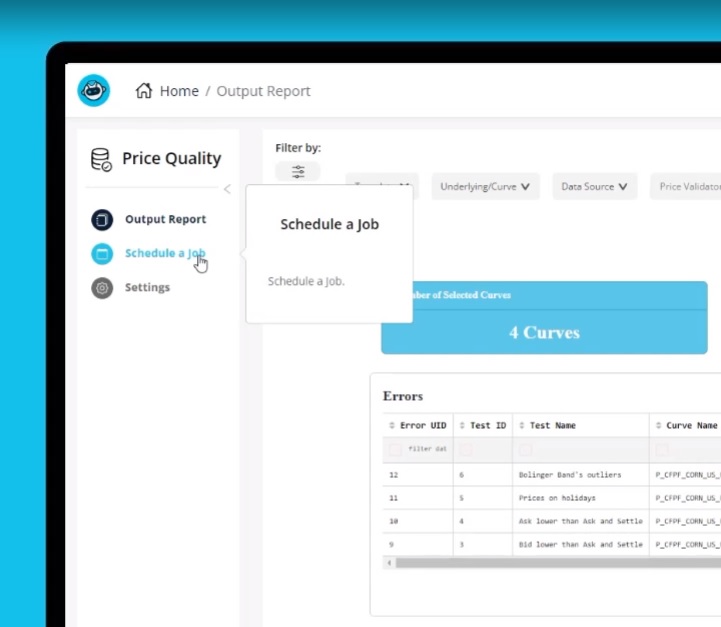

Our platform is a one-stop shop type of tool that utilizes systematic test cases to guarantee price quality for users. Thus, it eliminates the need for manual validation and therefore increases operational efficiency. You might be thinking that all this sounds great, but still wonder how, in fact, does it work?

Well, systematic tests are sets of predefined procedures or rules that are designed to ensure that a particular system, process, or product meets certain standards or specifications. In commodity trading, systematic tests can be used to verify that the prices of traded commodities are accurate and of high quality. Simple as setting a few scheduled jobs that do it for you.

For example, a systematic test for commodity trading might involve comparing the price data received from multiple sources, such as exchanges and market data providers, to identify any discrepancies. This test could also involve checking for outliers or abnormal price movements that might indicate errors or potential fraud.

So, said simply, you can still have valuable insights, even with imperfect commodity trading data, or data from multiple sources, which can be quite messy to align when done manually in an inefficient way, with lots of space for human errors. These tests increase efficiency by ensuring that you don’t have to think about this anymore, but rely on automatic outlier detection or abnormal activity alerts.

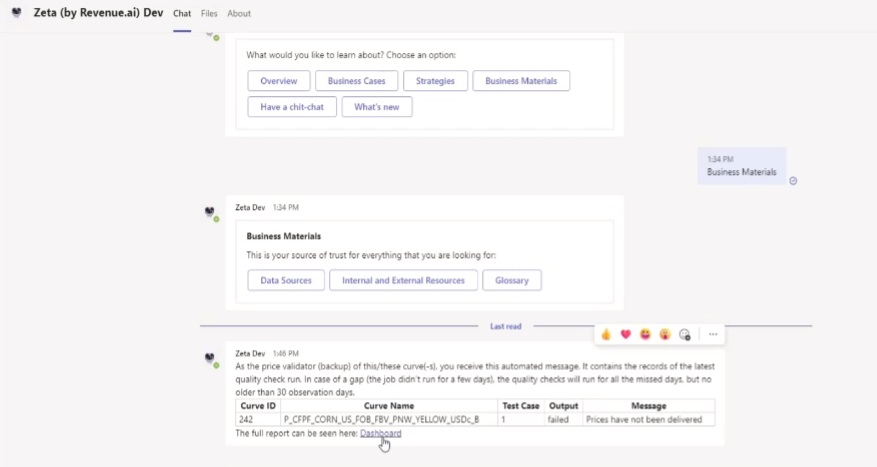

After you’ve scheduled a job, or subscribed to an alert, you can sit and rest, while Zeta does her job. When the time comes, Zeta will inform you in a Teams (or the chat of your preference) about the inconsistency found, as shown below:

Increasing Operational Efficiency for Commodity Traders with RAI

Revenue.AI helps reduce the time spent on checking the quality of the collected prices by more than 90% with the help of the intelligent assistant, Zeta. You can simply open the report and see all errors in your instruments, all in one place. Goes without saying that this also means instant improvement in operational efficiency.

Additionally, with our fresh partnership with Barchart, our customers can now access Barchart’s market data solutions within their commodities trading platform and AI assistant Zeta, providing them with real-time market data insights and analytics. Thus, increasing trust in the quality of data even more.

So, how to access this and any other information? Well, very easy actually.

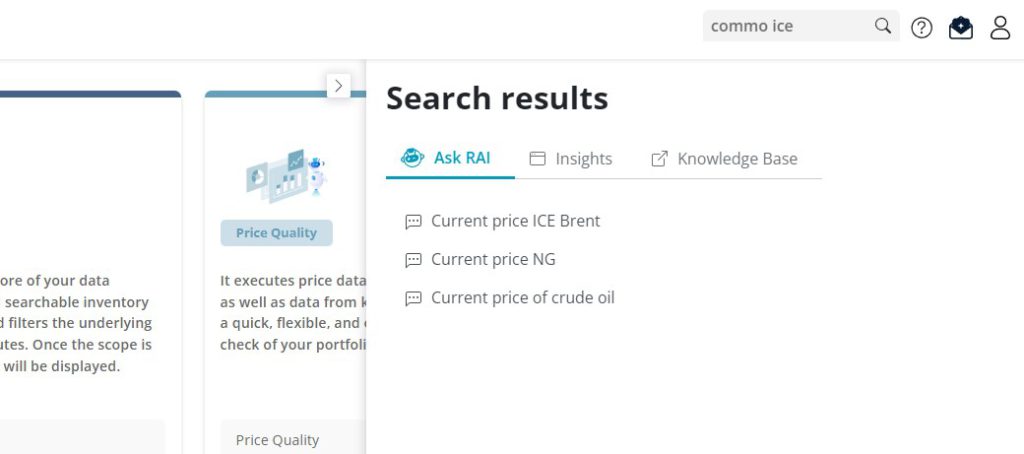

You can type in the Google-search-like Cognitive AI engine whatever you’d like to see. For example, I want to know the current price of ICE Brent. I would simply go into the platform, and to the Google-search-like cognitive engine, or as we like to call it, the Copilot:

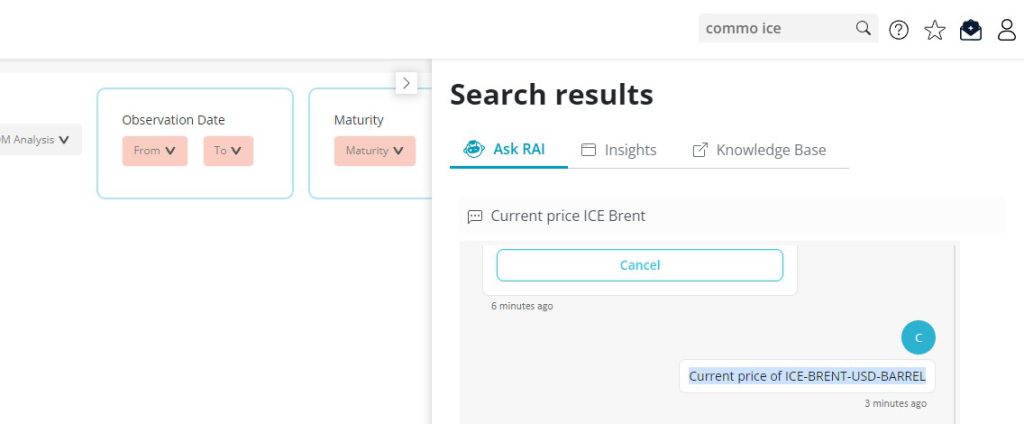

I don’t even have to do too good of a job typing it in. I just wrote commo and ice, and I already found what I needed. So, I will go ahead and click on Current price ICE Brent. And, here’s what I get:

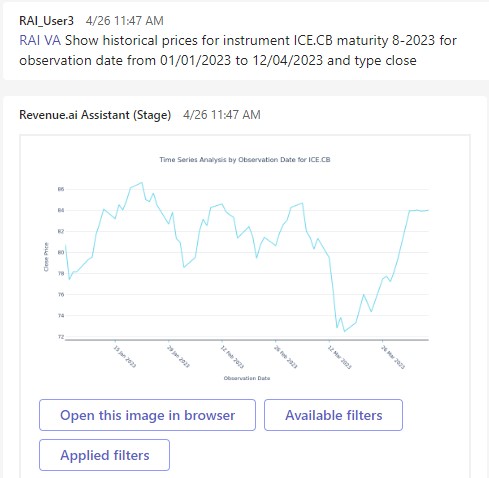

After selecting the values you’d like to see, it pops up a report. But, here’s another way to get the same output. Let’s say that you are traveling, but you’d like this info on the go. You can do the same thing in Teams, for example, details shown below:

So, firstly, Zeta can automate the data reconciliation process, helping to save time and reduce the risk of errors. By ensuring that the data is accurate and consistent, you, as a commodity trader can make better trading decisions and reduce your risk exposure. Then, you can go to the Zeta Copilot any time, when you’d like to see more specific information, by simply chatting with the intelligent assistant, or using the Google-search-like engine to find relevant information.

This allows you to focus on only strategic aspects of commodity trading and improve overall efficiency in your work. If Zeta has sparked your imagination, you can get to know her better by reading this article.

What is also important to note is that Revenue.AI’s solutions also address market risk challenges, but more about that in a separate article.

The role of AI in increasing operational efficiency

Artificial intelligence (AI) can be used to augment risk management in commodity trading in several ways. Here are some examples:

-

- Real-time monitoring and alerts: AI algorithms can be used to monitor market and trading activity in real-time, allowing traders to identify and respond to potential risks more quickly. For example, AI-powered risk management systems can analyze news and social media feeds for mentions of a particular commodity or company and alert traders to potential risks or opportunities.

-

- Predictive analytics: AI can be used to develop predictive models that can forecast market trends and potential risks. For example, machine learning algorithms can be used to analyze historical market data and identify patterns that can help predict future price movements.

-

- Portfolio optimization: AI can be used to optimize portfolio risk management by analyzing portfolio performance and suggesting changes to reduce risk exposure. For example, AI algorithms can analyze the correlations between different commodities and suggest adjustments to the portfolio to reduce risk.

-

- Fraud detection: AI can be used to detect potential fraud or market manipulation by analyzing trading data for unusual patterns or anomalies. For example, machine learning algorithms can analyze trading data to detect potential insider trading or market manipulation.

Overall, AI can help traders and risk managers make more informed decisions by providing them with real-time data analysis and predictive insights, which can help reduce risk exposure and improve overall performance. However, it’s important to note that AI should be used as a tool to augment human decision-making, rather than replace it entirely.