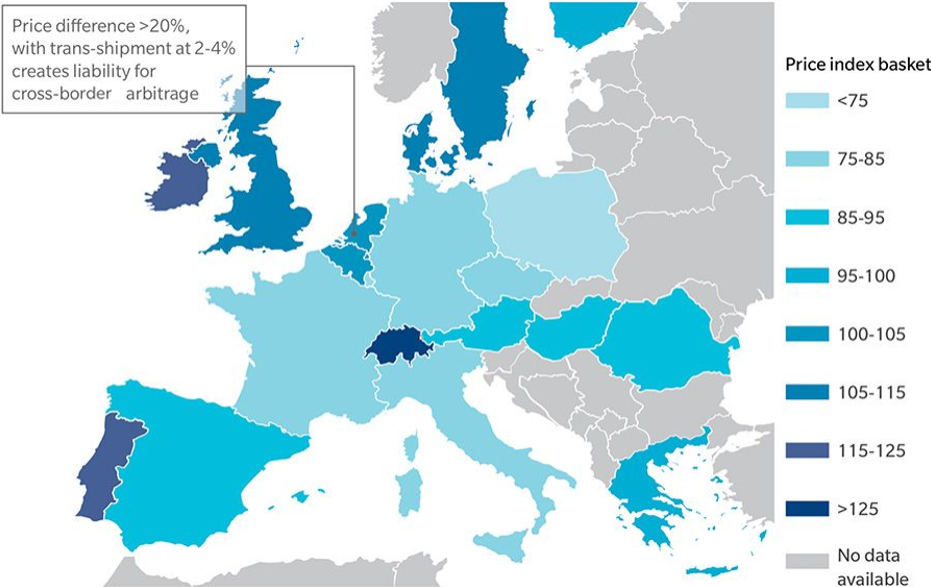

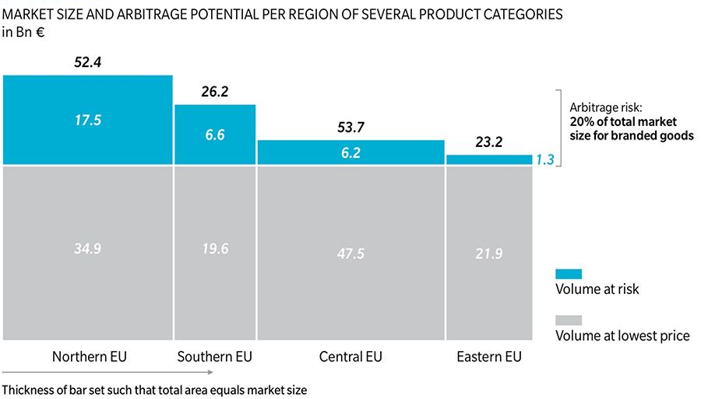

Historically, FMCG companies have run their businesses on a market by market basis. But opening of borders, creation of trade zones and rapid growth of e-commerce created new business opportunities as well as new challenges. The latest research indicates that circa 20% of the total revenues may be foregone due to cross-border arbitrage risk.

Companies such as Amazon evaluate trade terms in each country and buy at the lowest possible price. From wholesale to small shops & HORECAs*, everyone is becoming more price-savvy under pressure from better-informed consumers and is ready to buy cross-border when it makes sense. Consumers, too, are becoming more apt in deal-hunting, aided by price comparison websites.

The rapid growth of e-commerce alone has created new opportunities as well as new challenges for international trade. Consumers can now buy almost anything online at lower prices than ever before thanks to aggregator websites. Traditionally, FMCG companies applied different sets of trade terms to different countries. This has paved a way to a growing cross-border arbitrage threat for branded goods. The resultant risk is substantial and, for some companies may turn out to be existential.

In addition to cross-border retailer arbitrage threat, differences in consumer prices across markets add to FMCG challenges. Price comparison websites provide a new level of market transparency, while e-commerce giants like Amazon accelerate price changes even further. This poses a serious challenge to the effectiveness of promotional discounts and conventional pricing models.

Research shows that prices of identical goods can sometimes be 50% higher in some European countries vs others. Moreover, health and beauty products can be up to 70% more expensive in some countries across the EU. Some companies have found non-traditional ways to tackle cross-border arbitrage threats, including the following strategies: offering a differentiated product portfolio for different markets; harmonising prices and trade terms across all European markets; and more closely overseeing discounts that retailers are being given across all markets. Clearly FMCG companies need to get a better understanding of their primary sources of income to create new opportunities & expose potential threats for international trade. This calls for the end-to-end price transparency across all European markets.

How can Revenue.AI help to effectively manage cross-country arbitrage threats?

Our solution and holistic approach to the arbitrage problem is developed on the following steps:

Ability to generate a 360 price tracking dashboard, that will compare cross-border “Brick” & “Click” retailer prices to identify potential arbitrage threats & opportunities:

- Analyse price fluctuations by product & by geo location.

- Enhance it with an interactive map to show projected arbitrage clusters (e.g. Swiss residents are more likely to shop in Germany, France, or Italy if the difference in price outweighs anticipated transportation costs.)

Augment with Artificial Intelligent and Machine Learning for real-time alert notification system:

- If the product price fluctuates above set threshold in market A, we’ll immediately alert ‘prime targets’ of potential arbitrage (usually markets in close geographic proximity to market A)

- Forecast anticipated financial impacts of arbitrage risk on revenue, GMV and/or ROI

Strategic consulting integrated with Trade Terms to avoid arbitrage traps:

- We offer consulting support in particularly difficult cases or for strategic fixes via Trade Terms

What are the minimum data requirements to solve Cross-Border arbitrage problem?

- Weekly/ daily price tracking information from aggregator websites like Clavis, Keepah or similar

- Weekly Nielsen data breakdown by SKU, Retailer and Channel

OR

- Weekly / daily POS data

Companies can save millions by adopting this approach and therefore avoid so many disruptions in their business.

#pricearbitrage #crossborderarbitrage #revenuemanagement #RMconsunlting #arbitragethreat #arbitragerisk #arbitragetrap #fmcg #cpg #internationaltrade

Source: Retailer websites, Oliver Wyman analysis, Prices before VAT https://www.oliverwyman.com/our-expertise/insights/2019/dec/retail-consumer-journal-vol-7/crosscountry-arbitrage.html